Exploration

In 2022, the company continued its largest exploration programme (commenced in 2021) ever carried out by the Group at the West Kenya operations. The West Kenya exploration programme continued to deliver consistently encouraging high-grade drilling results.

Tanzania

Shanta holds exploration properties covering approximately 990 km2 in the under-explored ex-colonial mining areas of the geologically rich Lupa Goldfield surrounding New Luika (959 km2) and the Singida Greenstone belt (31 km2), which extends across the mining licences at Singida.

Through continued drilling campaigns, New Luika has established a solid operational track record for converting inferred resources to reserves and extending the mine life accordingly. A total of 597 Koz of new reserves have been added to the New Luika mine plan since 2015.

Targeted drilling locations within existing mining licences include:

- The Bauhinia Creek deposit is located within a moderately steep (±55°), NW-dipping shear zone, which is silicified and mineralised by an auriferous quartz (± carbonate) vein system. BC is currently in production by way of underground mining. Single mineralised, economic veins trend parallel to the shear zone geometry, but pinch or taper out towards the ENE, abruptly terminating against the Nose Fault to the WSW.

- BC East Area 1 is located approximately 2 km to the northwest of the NLGM processing plant and represents an extension of the main BC deposit and an immediate extension of the currently operational underground mine, to the east of the Central Fault, which offsets the mineralized structure. The BC East Area 1 structure strikes approximately NNE - SSW and dips ~50° to NW. Gold mineralization at BC East Area 1 is associated with quartz (± carbonate) veining and low sulphides (predominantly pyrite) mineralization. The mineralised zone is hosted by granodioritic rocks. The structure drilled and modelled so far at BC East Area 1 covers a strike extent of approximately 270 m. It is estimated that the true widths of the mineralised zones are about 80% - 95% of the intersected widths in the drillholes.

- Luika is located 1.8 km to the northwest of the NLGM Processing Plant. The Luika deposit is currently in production by way of underground mining. The orebody strikes approximately NNE - SSW and dips ~50° to NW. Gold mineralization at Luika is closely associated with quartz veining (silicification) and low sulphides mineralisation (predominantly disseminated pyrite ~1- 3%). The mineralised zones are presented by moderately to sub-vertical dipping quartz veins hosted by granodioritic rocks. The deposit depicts relatively higher-grade westerly plunging shoots which have the potential to host significant economic mineralisation below the presently explored area and will continue to be the target of future exploration drilling programs.

The Key Targeted drilling location within the economic circle of New Luika include:

- Porcupine South (Western Extension) - is located about 22 km to the east of the NLGM Processing Plant with total JORC compliant resources of 962kt grading 2.08 g/t containing 64k oz as of 30 June 2021. The Northern Trend of Porcupine South strikes northwest – southeast. Drilling at the Western Extension of Porcupine South is one of three highly prospective targets on the licence, of which the other two targets are expected to be drilled in 2022. Gold mineralisation is associated with quartz veins hosted by a shear zone at the granite – dolerite contact and steeply dips to the northeast. Higher gold mineralisation grades in the Northern Trend appear to be closely associated with strong silica and sulphides (pyrite) alteration. Pyrite occurs as disseminated, semi massive bands and stringers that infill fractures. The western extension (Area 1 and Area 2) drilled and modelled so far covers a strike extent of approximately 600 m. The ongoing drilling program is designed to test the mineralised structure to level 1120 mRL (~120m vertical depth).

During 2023, exploration activities will focus on three distinct areas to extend the life of the operation:

- Targeted locations within existing mining licences adjacent to the underground reserves at our Bauhinia Creek, Luika and Ilunga deposits;

- Within the economic circle of New Luika; and,

- Regionally, utilizing prospective exploration ground held by the Company within the Lupa Goldfield.

The group regularly provides exploration updates, and these can be found in the news and media section of our website.

Kenya

Shanta acquired the West Kenya Project in late 2020, believed to be among the highest grading gold projects in Africa, and a high-quality addition to the asset portfolio. At the time of the acquisition, the project had a high-grade NI 43-101 compliant inferred resources of 1,182,000 ounces grading 12.6 g/t at the Isulu/Bushiangala deposits. Other benefits of the acquisition for the Shanta Gold Shareholders include: A major presence in a geologically rich and underexplored greenstone gold region; Expands Shanta’s operating presence in East Africa with a diversified portfolio of exceptional assets delivering long-term growth; An established Centre of Excellence at the New Luika Gold Mine will advance the West Kenya Project and complement the project team based in Kisumu, Kenya; Increases Shanta’s high-quality gold resource inventory to over 3 Moz contained gold with the prospect of future growth; and Complementary language and legal systems between Tanzania and Kenya based on English law.

As at the end of 2022, the West Kenya Project covers approximately 556 km2 of the highly prospective Lake Victoria greenstone gold field in western Kenya, and has total Inferred resources of 1,719,000 ounces grading 5.21 g/t, including 722,000 ounces Indicated grading 11.45 g/t.

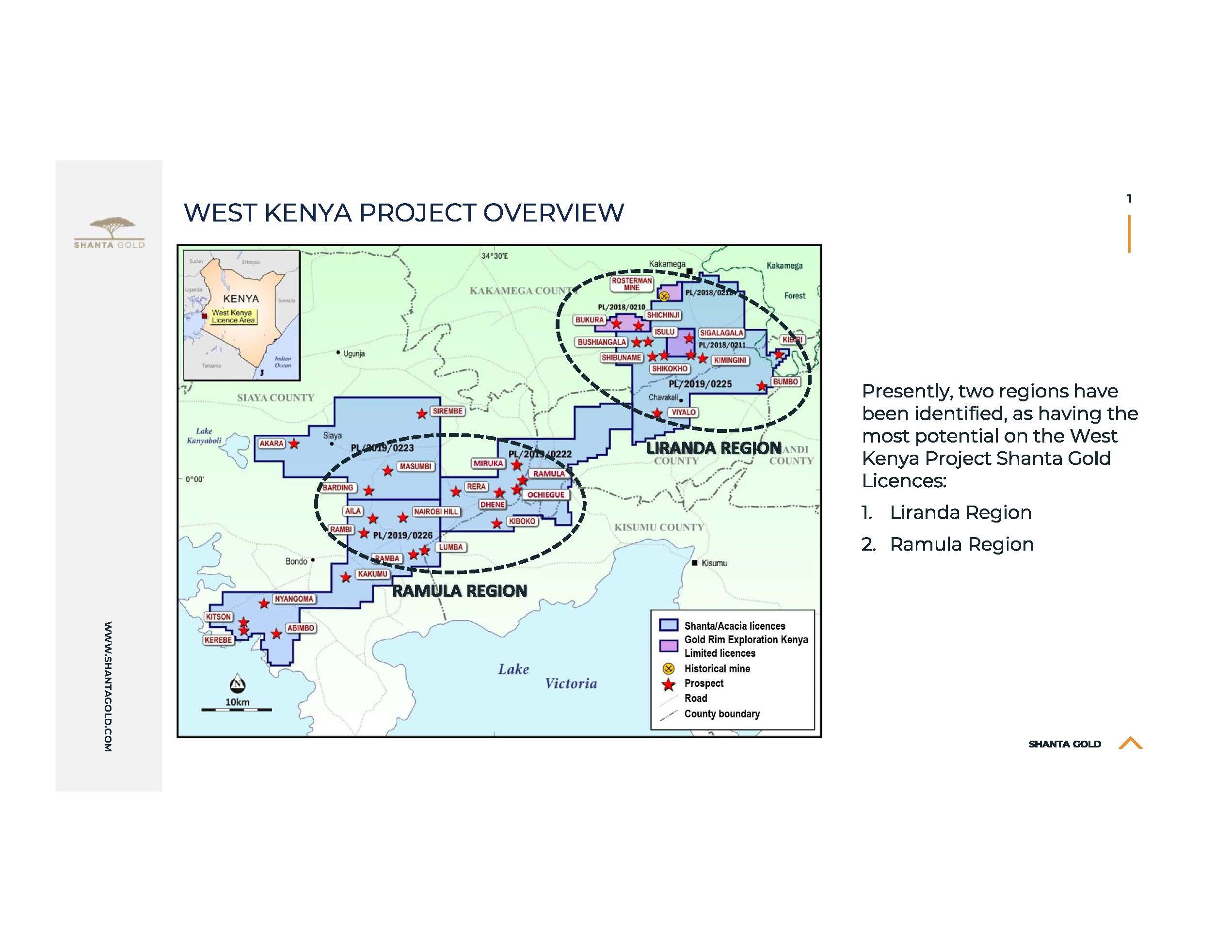

Presently, two potential mining centers have been identified on the West Kenya Project Shanta Gold Licences:

- Kakamega Potential Mining Centre (Isulu-Bushiangala is the main resource-stage target) and

- Ramula Potential Mining Centre (Ramula is a new resource-stage target)

Other highlight targets include:

- Miruka, Ochegue and Anomaly 22 are recent targets that have the potential for a discovery of a reasonably sized deposit in proximity to Ramula. 2023 exploration on these targets is aimed to deliver Inferred resources.

- Kimingini is an advanced-stage target potential to deliver a resource in proximity to Isulu-Bushiangala.

- Rosterman-Kakamega is an early-stage, poorly tested target in immediate proximity to the historic colonial mine, which had produced 0.25Moz @ 12.5g/t Au.

- Several highly prospective additional targets in different exploration stages are identified in 10-30km distance from the Ramula and Isulu centers, including Barding-Masumbi, Aila, Nairobi Hill, and Viyalo.

Post-acquisition, Shanta has undertaken various key processes to enhance the value accretion of this portfolio and to accelerate a construction decision for a third mine. Some of the more noticeable processes undertaken include:

- Commenced an independent Scoping Study for the high-grade West Kenya Project (Isulu/Bushiangala deposits), which was finalised in October 2020 and highlights include: Life of Mine (“LOM”) gold production of 949 Koz; Average annual gold production of 105 Koz for 9 years; Average head grade mined at 9.3 g/t; Open pit mining for 2 years followed by underground mining; and Conventional CIL processing plant with an annual processing capacity of 480 kt.

- Appointed Yuri Dobrotin, P.Geo as Group Exploration Manager effective 1 January 2021.

- Embarked on an infill drilling programme at the Isulu and Bushiangala deposits aimed at upgrading ounces from the Project’s NI43-101 compliant Inferred Mineral Resource Estimate into the Indicated Resource category down to a depth of 600 metres, across three drilling phases.

- In March 2022, Shanta announced a Resource update for the Isulu and Bushiangala deposits with highlights being 348 Koz grading 11.7 g/t converted to Indicated in total at a conversion rate of over 100%, following Phase 1 drilling.

- Continuation of other exploratory works and prioritisation of targets across the full portfolio in West Kenya.

- A total of 63,700 metres (“m”) were drilled at West Kenya in 2021 and 2022 - including 12,800 m across district targets - costing US$ 10.5 million of direct drilling expenditure.

- In March 2022, Shanta announced a maiden resource estimate for the Ramula target of 434 Koz grading of 2.08 g/t which increased the total resources at our West Kenya Project by a significant 37% to 1.6 million oz.

- In March 2022, Shanta announced a JORC 2012 compliant Mineral Resource Estimate at the Bumbo deposit, based on the new remodeling within the Kakamega Region is now declared totaling 2.49 Mt at 2.7% Zn, 1.21% Cu, 32.12g/t Ag, 0.28% Pb, and 0.76 g/t Au, down to depth of 250m, and outlined a previously unexplored downdip extension of the deposit.

- In May 2022, commenced with various feasibility related studies.

During 2023, the West Kenya exploration team has the following key priorities:

- Continue infill drilling programme and provide an updated mineral resource estimate at Isulu-Bushiangala.

- Ongoing expansion of the drilling programme at the Ramula Camp aiming for new discoveries, mineral resource increase and additional conversion to the Indicated category.

- Continue feasibility related studies for the Kakamega and Ramula Camps

The group regularly provides exploration updates, and these can be found in the news and media section of our website.